are funeral expenses tax deductible in 2020

These expenses may include. Placement of the cremains in a cremation urn or cremation burial plot.

Taxing The Digitalization Of The Economy The Two Pillar Approach By Bundesverband Der Deutschen Industrie E V Issuu

Up to 10000 of the total of all death benefits paid other than CPP or QPP death benefits is not taxable.

. Are funeral expenses tax deductible in 2021Individual taxpayers cannot deduct funeral expenses on their tax return. Many individuals may be confused by this statement. Funeral Costs as Qualifying Expenses.

Assume when you file your taxes your adjusted gross income AGI is 75000 while your spouses AGI is 25000. Qualified medical expenses include. According to the IRS funeral expenses are not tax deductible unfortunately.

Unit 1712 Elkridge MD 21075 USA. Burial or funeral expenses includi. Funeral Costs as Qualifying Expenses The costs of funeral expenses including embalming cremation casket.

Are funeral expenses tax deductible in 2021. Investment interest expense attributable to tax-exempt income is not deductible. The amount of these exemptions can vary.

Its 117 million at the federal level as of 2021 while its only 1 million in Oregon. What funeral expenses are tax deductible. If the IRS requires the decedents estate to file an estate tax return the estates representative may be able to include funeral expenses as.

Is an autopsy required for life insurance. This includes government payments such as Social Security or Veterans Affairs death benefits. The personal representative may file an amended return Form 1040-X for 2020 claiming the 500 medical expense as a deduction subject to the 75 limit.

If the return is not complete by 531 a 99 fee for federal and 45 per state. The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are deductible. If the estate was reimbursed for any of the funeral costs you must deduct the reimbursement from your total expenses before claiming them on Form 706.

The cost of transporting the body for a funeral is a funeral expense and so is the cost of transportation of the person accompanying the body. The 300 of expenses incurred in 2021 can be deducted on the final income tax return if deductions are itemized subject to the 75 limit. IRS rules dictate that all estates worth more than 1158 million in the 2020 tax year are required to pay federal taxes at which point they can take advantage of tax deductions on the funeral expenses of a loved one.

Such reimbursements are not eligible for a deduction. The Internal Revenue Service IRS sets strict rules about what expenses can and cannot be deducted from your tax bill. Basic Service Fee of the funeral director.

These need to be an itemized list so be sure to track all expenses. Funeral expenses when paid by the decedents estate may be taken as a deduction on a decedents estate tax. According to the IRS funeral expenses including cremation may be tax deductible if they are covered by the deceased persons estate.

Proof of death is necessary when filing a life insurance claim. The taxes are not deductible as an individual only as an estate. Individual taxpayers cannot deduct funeral expenses on their tax return.

A death benefit is income of either the estate or the beneficiary who receives it. In this way are funeral expenses tax deductible for 2019. What funeral expenses are tax deductible.

Are funeral expenses tax deductible in 2020. Any family members out-of-pocket expenses for your. You cant take the deductions.

In short these expenses are not eligible to be claimed on a 1040 tax form. Any family members out-of-pocket expenses for your. Schedule J of this form is for funeral expenses.

While the IRS allows deductions for medical expenses funeral costs are not included. Regulated Funeral Plan Providers Dignity Funeral Plans. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person.

You may not take funeral expenses as a deduction on a personal income tax return. That depends on who received the death benefit. The IRS deducts qualified medical expenses.

Funeral expenses are not tax deductible because they are not qualified medical expenses. While individuals cannot deduct funeral expenses eligible estates may be able to claim a deduction if the estate paid these costs. The IRS does not levy taxes on most estates so only the most prosperous can benefit from tax deductions on their funeral expenses.

You will need a certified copy of the death certificate a police report a. But for estates valued above 114 million in 2019 or 1158 million in 2020 deducting funeral expenses on the estates Form 706 tax return would result in a tax saving. Asking permission not to attend class.

Estates arent liable for these taxes unless and until their net values after deducting certain expenses exceed a threshold called an exemption. Qualified performing artists. This is due within nine months of the deceased persons death.

For most individuals this means that whether you pay in part or in full out of your pocket you cannot deduct the expense on the federal tax form. Conditions for Cremation Tax Deductibility. The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax return filed for a.

Funeral expenses paid by your estate including cremation may be tax-deductible. For the 2020 tax. If the beneficiary received the death benefit see line 13000 in the Federal Income Tax and Benefit Guide.

The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases. No deduction for funeral expenses can be taken. If your family does not know your plan to pay for the funeral expenses from your estate your estate will not get any tax deductions.

In order for funeral expenses to be deductible you would need to have paid for the funeral expenses from the estates funds that you are in charge of settling. As stated by the IRS paying for funeral or cremation expenses out of your pocket is not tax-deductible. Accounting for reimbursed expenses.

While the IRS allows. 7021 hollywood blvd los angeles ca 90028 1 301 202-8036 6335 Green Field Rd. Funeral expenses are not tax-deductible.

Placement of the cremains in a cremation urn. Deductible medical expenses may include but are not limited to the following.

Financial Report 2020 Wiener Stadtwerke By Wstw Issuu

Make Use Of All Those Tax Deductions Germany Has To Offer Sib

Report International Conference On Inclusive Insurance 2020 Digital Edition

Irs Announces Higher Estate And Gift Tax Limits For 2020

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

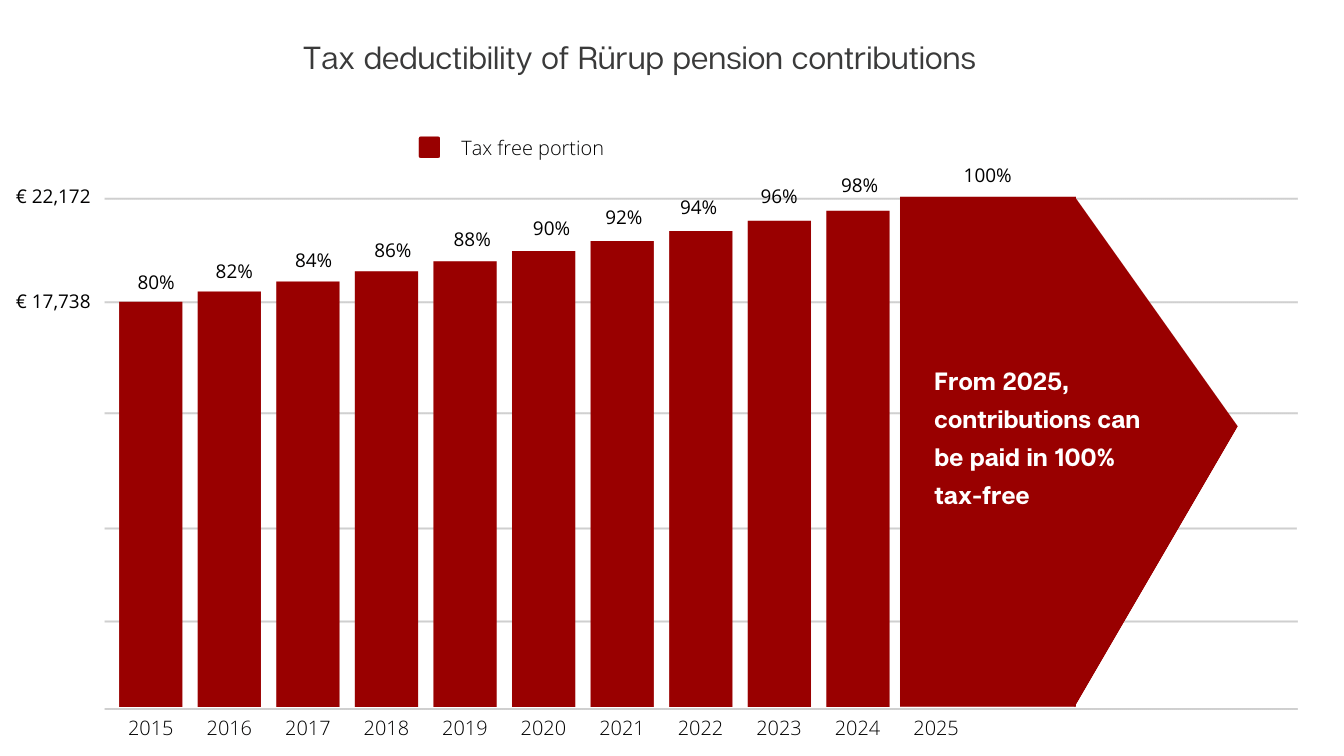

Rurup Pension In Germany For Employees Self Employed

Amber Wedding Seating Chart Template Printable Seating Etsy Seating Chart Wedding Template Seating Chart Wedding Wedding Posters

Year End 2020 May Not Be The Same As Last Year For Payroll Taxes And Compensation

Immc Swd 282021 29293 20final Eng Xhtml 6 En Autre Document Travail Service Part1 V5 Docx